The 9-Second Trick For IRS Provides Relief for ERC Q4 2021 Penalties - BDO Insights

Claim Payroll Tax Credits on 2nd Quarter Form 941 - Wouch Maloney CPAs & Business Advisors

10 Simple Techniques For Can A Bank Qualify For Employee Retention Credits?

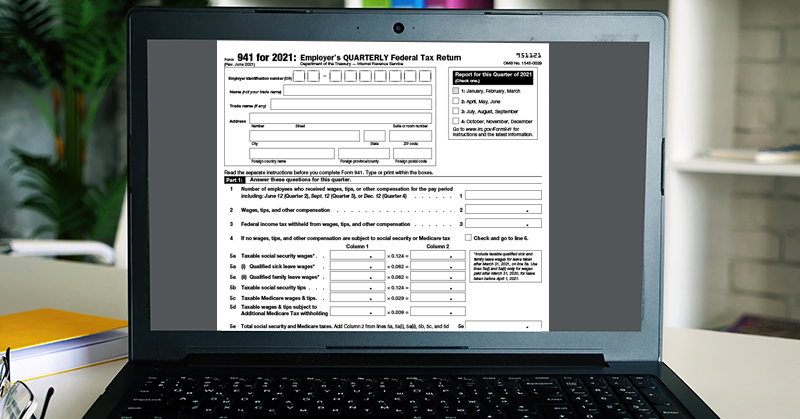

For more details, companies must refer to guidelines for the suitable tax kind. Failure to pay charges could result if payments are not made according to these particular parameters. For PEO/CPEO clients who had work tax deposits lowered, in addition to received advance payments by filing Kind 7200, they will require to repay these under their PEO/CPEO accounts.

The IRS published guidance to clarify how it would work. If a qualified employer uses a PEO or CPEO, the retention credit is reported on the PEO/CPEO aggerate Form 941 and Set up R. Looking forward If employers have questions or need more details, they must work with their accounting professional and payroll professional.

Page Last Evaluated or Updated: 27-Dec-2021.

The Worker Retention Credit ("ERC") continues to supply a wide range of employers with rewarding refundable payroll tax credits for certified incomes paid to workers in 2020 and 2021. "We have actually helped numerous companies get the ERC over the previous two years since the credit was introduced. We have actually not seen a downturn in application approvals by the IRS," says Martin Karamon, principal at Cherry Bekaert who leads the Firm's ERC Group.

An Unbiased View of Employee retention credit guidance and resources - AICPA

"Unfortunately, many business still have not examined whether they get approved for the 4 separate credits." As we reach 2 years of ERC availability, Karamon and his team answer the most regularly asked questions about this payroll tax credit. What are visit this YouTube channel that allow an automobile dealer to get approved for the ERC due to the results of COVID-19 requireds restricting commerce, travel, or group meetings!.?.!? The ERC is a refundable payroll tax credit that can be as high as $5,000 per staff member in 2020 and as high as $21,000 per employee in 2021.

How to Claim the Employee Retention Credit - Hourly, Inc.

ERC credits are calculated based on the qualifying incomes paid to employees throughout eligible employer status. For most business benefiting from this program, the refundable tax credits are well in excess of the payroll taxes paid by the companies. ERC advantages can be larger than the amounts a company received in PPP funding.